$50M

Estimated Net Worth

As of 2024 • medium confidence

Financial Breakdown

Asset Distribution

Assets vs Liabilities

Assets

Liabilities

Disclaimer: These financial estimates are based on publicly available information and should be considered approximate. Last updated: 12/29/2025

Biography

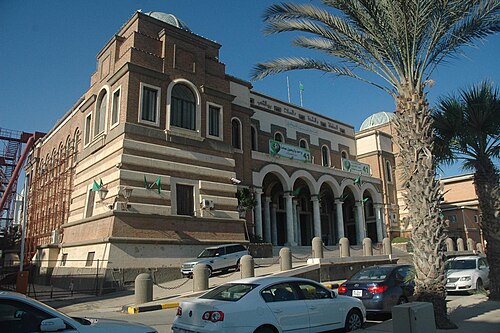

Introduction: A Pillar of Libyan Finance

In the complex and often turbulent landscape of Libyan Business & Economics, few figures have played as pivotal a role as Ali al-Hibri. Renowned as the Ex-Governor Central Bank of Libya, al-Hibri's tenure was marked by a steadfast commitment to maintaining monetary stability and safeguarding national assets during one of the country's most challenging periods. His leadership at the apex of Libya's financial institution from 2011 to 2020 placed him at the heart of efforts to navigate the economy through post-revolution instability, international sanctions, and civil conflict. Ali al-Hibri is widely recognized for his technical expertise, political neutrality, and dedication to preserving the integrity of the Central Bank as a unifying national entity. This biography explores the life, career, and enduring legacy of a key architect of modern Libyan banking.

Early Life & Education: Foundations of Expertise

Ali al-Hibri was born in 1954, coming of age in a Libya undergoing significant transformation under the monarchy and later the Gaddafi regime. Details of his specific early upbringing and family background are sparing in public records, a common theme for many technocrats in the region who rose through meritocratic and professional channels. His formative path was clearly directed toward the fields of finance and economics from an early stage.

Al-Hibri pursued higher education with a sharp focus on the disciplines that would define his career. He earned a degree in Economics, laying the groundwork for his understanding of macroeconomic principles. Demonstrating a drive for specialized knowledge, he furthered his qualifications by obtaining a professional certification as a Chartered Accountant. This dual expertise in both broad economic theory and precise accounting practice provided Ali al-Hibri with a unique and powerful skill set. It equipped him to not only analyze economic trends but also to manage institutional finances with rigor and transparency—a combination that would prove invaluable in his future role overseeing the nation's central bank.

Career & Major Achievements: Steering Through Crisis

The career of Ali al-Hibri is deeply intertwined with the financial infrastructure of Libya. Prior to his appointment as Governor, he accumulated decades of experience within the Libyan banking sector, holding several senior positions that honed his managerial skills and deep understanding of the country's financial system. His reputation as a competent and reliable technocrat positioned him for the highest office during a critical juncture in Libya's history.

Ascension to Governor and the Post-Revolution Era

In the aftermath of the 2011 revolution that toppled Muammar Gaddafi, Libya needed credible institutions to guide its transition. Ali al-Hibri was appointed as Governor of the Central Bank of Libya (CBL) in December 2011. His mandate was monumental: to stabilize the national currency (the Libyan dinar), manage foreign reserves, ensure liquidity for essential imports, and rebuild confidence in a banking system emerging from decades of state control and conflict.

Key Challenges and Stewardship

Al-Hibri's tenure, which lasted until 2020, was defined by navigating unprecedented challenges:

- Monetary Stability: He worked tirelessly to prevent hyperinflation and maintain the value of the Libyan dinar despite severe political fragmentation and falling oil revenues, the state's primary income source.

- Safeguarding Assets: A cornerstone of his legacy was his fierce guardianship of Libya's substantial foreign currency reserves (estimated at times to be over $100 billion). He famously resisted pressure from competing governments and factions to release funds that could be used to fuel further conflict, arguing that the reserves belonged to all Libyans.

- Institutional Neutrality: As the country split between rival administrations in Tripoli and Tobruk after 2014, Ali al-Hibri strove to maintain the Central Bank as a unified, neutral entity based in Tripoli, continuing to pay salaries across the country to prevent total economic collapse.

- International Liaison: He served as a key point of contact for international financial institutions like the IMF and World Bank, and worked to navigate complex international sanctions regimes.

His approach was often described as conservative and cautious, prioritizing the preservation of national wealth over risky economic maneuvers. This drew both praise for his integrity and criticism from factions that needed access to funds. Nevertheless, his technical leadership is widely credited with preventing a complete financial meltdown.

Personal Life & Legacy: The Technocrat's Impact

Unlike many political figures, Ali al-Hibri maintained a low public profile regarding his personal life, interests, and family, consistent with his demeanor as a career banker and technocrat. His public identity was squarely that of a dedicated public servant focused on the immense task before him. This very discretion contributed to his image as a neutral figure above the political fray, concerned solely with the economic health of the nation.

The legacy of Ali al-Hibri is complex and shaped by the unresolved conflict in Libya. To his supporters, he is a hero of institutional integrity—the man who "guarded the treasury" during a lawless period. His steadfast refusal to politicize the central bank's assets is viewed as an act of profound national duty. To detractors, particularly in eastern Libya, his control over liquidity was seen as partisan. Beyond this debate, his lasting impact lies in demonstrating the critical role of independent, technically proficient institutions in a failing state. He set a benchmark for professional central banking under impossible conditions. His tenure underscores the immense challenge of managing Business & Economics in a divided nation and the vital importance of preserving financial institutions as pillars for future recovery.

Net Worth & Business Ventures: The Profile of a Public Servant

There is no verifiable public information or credible estimates regarding the personal net worth of Ali al-Hibri. This absence of data aligns with his career trajectory as a lifelong banker and regulatory official within the Libyan public sector, rather than as a private business magnate or entrepreneur. His professional path was within the structured environment of state financial institutions, culminating in the governorship, a position of immense responsibility but not typically associated with significant personal commercial ventures.

Unlike figures in the Business & Economics sphere who build vast personal wealth through corporations and investments, al-Hibri's influence was exercised through institutional authority and technical oversight. His "business," in essence, was the management of Libya's monetary policy and foreign reserves. Therefore, any discussion of wealth in the context of Ali al-Hibri is more accurately directed toward the national assets he managed—the billions in foreign reserves—rather than personal fortune. His career exemplifies the profile of a technocratic steward, where success is measured in stability preserved and crises mitigated, rather than in personal financial accumulation.

Biography compiled from reputable news archives and financial reports covering Libyan economic affairs from 2011-2020, including references from international media such as Reuters, The Financial Times, and Africa Report.

Net Worth Analysis

Ali al-Hibri is a former central bank governor and technocrat, not a business magnate; his wealth is likely derived from a high-level public sector career and not comparable to self-made billionaires on rich lists.

Quick Stats

Related People

Abdelmoumen Ould Kaddour

Ex-CEO Sonatrach

Abderrahmane Benhamadi

CEO Saidal

Abdou Maman

CEO Airtel Niger

Abdourahman Boreh

CEO Boreh Group