$50M

Estimated Net Worth

As of 2024 • medium confidence

Financial Breakdown

Asset Distribution

Assets vs Liabilities

Assets

Liabilities

Disclaimer: These financial estimates are based on publicly available information and should be considered approximate. Last updated: 12/30/2025

Biography

Introduction: Architect of African Innovation

Eric Idiahi stands as a pivotal figure at the intersection of finance, technology, and entertainment in Africa. As the Managing Partner and co-founder of Ventures Platform, he has carved a niche as one of Nigeria's most influential early-stage investors. His work is instrumental in shaping the continent's startup ecosystem, particularly within the dynamic sectors of Entertainment technology and fintech. Born in Nigeria in 1984, Eric Idiahi's journey from corporate finance to venture capital exemplifies a deep commitment to fostering homegrown innovation. His key achievement lies in building Ventures Platform into a preeminent pan-African fund, backing groundbreaking companies that are solving fundamental challenges and capturing opportunities across Africa. Through strategic capital and mentorship, Eric Idiahi is not just funding businesses; he is actively constructing the infrastructure for Africa's digital and creative future.

Early Life & Education: Laying the Foundation

Eric Idiahi's formative years were shaped within the vibrant and complex economic landscape of Nigeria. Born in 1984, he came of age during a period of significant transition for the country, developing an early awareness of both its immense potential and its systemic challenges. This environment likely fostered a problem-solving mindset and a resilience that would later define his investment philosophy.

His academic path was meticulously crafted towards a career in high finance. Eric Idiahi pursued a Bachelor's degree in Accounting, establishing a strong foundation in financial principles, audit, and corporate governance. Understanding the need for global perspective and advanced strategic tools, he furthered his education with a Master of Business Administration (MBA). This powerful combination of rigorous accounting discipline and broad business strategy equipped him with a unique lens to evaluate companies—balancing meticulous financial diligence with visionary growth potential.

These formative experiences, rooted in Nigeria but augmented by global business education, provided Eric Idiahi with the essential toolkit. He gained deep insights into how capital flows, how businesses are structured, and what separates sustainable enterprises from fleeting ventures. This period was crucial in transitioning his perspective from that of a traditional financier to that of a builder, setting the stage for his pioneering work in the nascent African venture capital scene.

Career & Major Achievements: Building the Venture Ecosystem

Eric Idiahi's professional journey began in the structured world of corporate finance and auditing. He cut his teeth at PricewaterhouseCoopers (PwC), one of the world's leading professional services networks. His role at PwC involved auditing major financial institutions, providing him with an unparalleled ground-floor view of risk management, regulatory frameworks, and the inner workings of large, complex organizations. This experience was invaluable, instilling a discipline of thorough due diligence that he would later bring to the often-opaque world of startup investing.

Co-founding Ventures Platform

The pivotal turn in Eric Idiahi's career came with the co-founding of Ventures Platform in 2016. Recognizing a glaring gap in the market for early-stage, high-conviction capital for African innovators, he moved from analyzing established corporations to betting on future ones. As Managing Partner, Eric Idiahi helped define the fund's core thesis: to back mission-driven founders building platform solutions for Africa's systemic barriers across financial services, healthcare, logistics, and notably, Entertainment and media.

Strategic Investments and Sector Impact

Under his leadership, Ventures Platform has been an early investor in some of Africa's most celebrated tech success stories. The fund's portfolio is a testament to Eric Idiahi's vision, including companies like:

- Paystack: A payments processing company whose landmark acquisition by Stripe in 2020 for over $200 million validated the entire African fintech ecosystem and stands as a monumental exit for its early backers, including Ventures Platform.

- Mono: A leading open banking infrastructure provider, enabling digital financial innovation across the continent.

- Reliance Health: A technology-driven healthcare provider making quality care accessible and affordable.

- Termii: A leading communications platform-as-a-service for businesses in Africa.

In the Entertainment and media technology space, Eric Idiahi's strategy focuses on startups that leverage technology to transform content creation, distribution, and monetization. This includes investments in companies revolutionizing film, music, gaming, and digital media, recognizing the explosive growth of Africa's creative industries and their convergence with tech.

Ecosystem Advocacy and Thought Leadership

Beyond deploying capital, Eric Idiahi is a vocal advocate for strengthening the African tech ecosystem. He actively engages in policy discussions, founder mentorship, and public speaking, emphasizing the need for supportive regulations, local talent development, and patient capital. His perspective as an operator-investor with a strong financial background makes him a sought-after voice on panels and in publications discussing the future of African innovation.

Personal Life, Philanthropy & Legacy

While Eric Idiahi maintains a relatively private personal life, his professional philosophy suggests a deep-seated belief in empowerment and systemic change. His approach to venture capital is inherently impact-oriented, seeking investments that generate both substantial financial returns and positive societal transformation. This dual-purpose mindset likely extends into his personal philanthropic endeavors, which are believed to focus on education and economic empowerment, though specific details are often kept out of the public spotlight.

The legacy Eric Idiahi is building extends far beyond financial metrics. He is cultivating a new generation of African entrepreneurs and proving that world-class, scalable companies can be built from the continent. By providing not just capital but also strategic guidance and access to networks, he is helping to de-risk entrepreneurship in Africa. His lasting impact will be measured by the success of the founders he backs and the foundational companies they build—enterprises that will define Africa's digital economy for decades to come. Eric Idiahi's story is fundamentally about shifting the narrative from aid to investment, from extraction to homegrown creation.

Net Worth & Business Philosophy

While the exact net worth of Eric Idiahi is not publicly disclosed, it is intrinsically linked to the performance and carried interest from the Ventures Platform fund. The fund's successful exits, most prominently the landmark Paystack acquisition, indicate significant financial success for its managing partners. His wealth is a reflection of the value created within the ecosystem he helps fund.

Eric Idiahi's business philosophy is characterized by conviction investing at the earliest stages. He and his team at Ventures Platform prioritize deep sector understanding, focusing on founders with unique insights into large, underserved markets. They look for businesses with the potential to become critical infrastructure—"platforms"—that enable further innovation. This philosophy avoids fleeting trends in favor of foundational bets on technology that can reshape industries like Entertainment, finance, and healthcare in Nigeria and across Africa. For Eric Idiahi, true success is creating a virtuous cycle where investment returns are reinvested into the next wave of African innovators, ensuring sustainable growth for the continent's digital landscape.

Net Worth Analysis

Eric Idiahi is a successful venture capitalist and co-founder of Ventures Platform, a leading African fund, but he is not listed on major billionaire rankings like Forbes Africa.

Quick Stats

Related People

2Baba (Innocent Idibia)

Veteran Artist & Activist

Aar Maanta

Singer & Composer

Abdel Aziz al-Mubarak

Oud Master

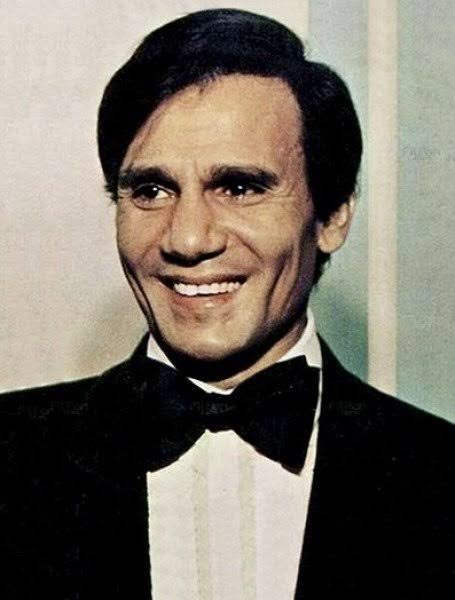

Abdel Halim Hafez†

Legend; “Nightingale”; “The Dark-Skinned Nightingale”