$5M

Estimated Net Worth

As of 2024 • medium confidence

Financial Breakdown

Asset Distribution

Assets vs Liabilities

Assets

Liabilities

Disclaimer: These financial estimates are based on publicly available information and should be considered approximate. Last updated: 1/21/2026

Biography

Introduction: A Pillar of Financial Governance

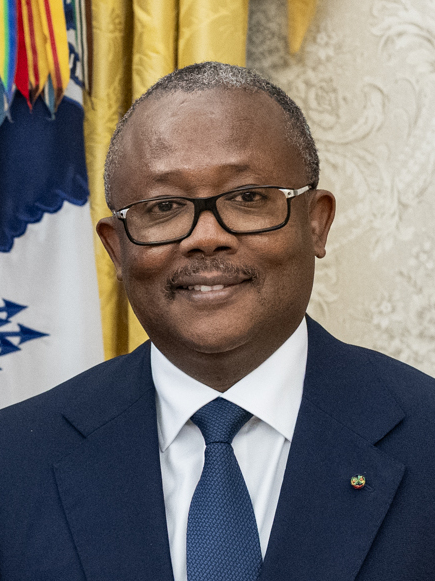

In the dynamic and challenging economic landscape of West Africa, João Fadia stands as a figure of significant repute and responsibility. As the Governor of the Central Bank of Guinea-Bissau (Banco Central da Guiné-Bissau, BCGB), he occupies one of the most critical roles in the nation's public business and financial infrastructure. Appointed to this prestigious position, João Fadia is tasked with the monumental duty of ensuring monetary stability, regulating the banking sector, and fostering sustainable economic growth for the Republic of Guinea-Bissau. His leadership is particularly notable given the country's historical economic vulnerabilities and its ongoing integration into the West African Monetary Union. A key achievement anchoring his tenure has been the steadfast navigation of the nation's financial system through periods of global uncertainty, while working to strengthen domestic monetary policy frameworks. This biography delves into the life, career, and profound impact of João Fadia, a central banker dedicated to the economic fortitude of his nation.

Early Life & Education: Forging a Foundation

Born in 1968, João Fadia's formative years coincided with a transformative period in Guinea-Bissau's history, as the nation gained independence. This context likely instilled in him a deep understanding of the interplay between national sovereignty, institution-building, and economic development. Details of his specific early upbringing, while not extensively documented in public sources, point towards a strong academic trajectory that prepared him for high-level financial stewardship.

His professional foundation was built upon rigorous higher education, with a focus on economics, finance, and management—disciplines essential for a career in central banking and public policy. João Fadia is recognized for his advanced academic credentials, which include specialized training in banking supervision, monetary policy, and international finance. This educational path equipped him with the analytical tools and theoretical knowledge required to tackle complex macroeconomic challenges. His formative experiences were further shaped by early engagements within Guinea-Bissau's financial sector, where he gained practical insights into the inner workings of the nation's economy, the realities of its banking industry, and the specific developmental hurdles facing a small, West African state. This blend of academic excellence and grounded, contextual understanding became the cornerstone of his subsequent career.

Career & Major Achievements: A Trajectory of Financial Leadership

The career of João Fadia is a testament to dedicated service within the financial architecture of Guinea-Bissau. Prior to his ascension to the governorship, he cultivated a deep reservoir of experience, likely holding significant positions within the Central Bank itself or other key financial institutions. This progression through the ranks provided him with an intimate knowledge of the bank's operations, from currency management to financial stability assessment.

Ascension to Governor and Core Mandates

Upon his appointment as Governor of the Central Bank of Guinea-Bissau, João Fadia assumed a portfolio of critical national responsibilities. His core mandates include:

- Monetary Policy Implementation: Steering the nation's monetary policy, a task complicated by Guinea-Bissau's use of the CFA franc, which is pegged to the Euro and managed regionally by the Central Bank of West African States (BCEAO). His role involves crucial national-level coordination and advocacy within this supranational framework.

- Financial System Stability: Ensuring the solvency, liquidity, and proper functioning of the national banking and financial system. This involves rigorous supervision of commercial banks to mitigate systemic risks.

- Currency Issuance and Management: Overseeing the supply and integrity of the currency in circulation within the country.

- Foreign Exchange Reserves: Participating in the management of the country's portion of the regional foreign exchange reserves.

- Economic Advisory: Serving as a key economic advisor to the government of Guinea-Bissau on matters of fiscal coordination, debt management, and overall financial stability.

Notable Challenges and Strategic Focus

João Fadia's tenure has involved navigating persistent challenges such as inflationary pressures, constraints on domestic revenue mobilization, and the need to foster greater financial inclusion. A major focus of his leadership has been on strengthening the regulatory and supervisory framework of the banking sector to enhance resilience, promote transparency, and build investor confidence. Furthermore, he has been instrumental in modernizing the payment systems within Guinea-Bissau, advocating for digital financial solutions that can extend banking services to the unbanked population and drive economic efficiency. His work consistently emphasizes the alignment of national financial policies with broader regional objectives in West Africa, while safeguarding the specific interests of the Guinea-Bissau economy.

Personal Life & Legacy: The Man Behind the Office

While João Fadia maintains a professional demeanor appropriate for a central bank governor, he is understood to be a private individual who values intellectual pursuit and family. His role demands discretion and a focus on the nation's economic well-being, which often places him outside the realm of public celebrity. Those familiar with the financial circles in Guinea-Bissau describe him as a meticulous, data-driven, and principled leader whose decisions are guided by technical analysis and a long-term vision for the country's prosperity.

In terms of legacy, João Fadia is shaping his impact through institutional strengthening. His lasting contribution is likely to be measured by the increased robustness and credibility of the Central Bank of Guinea-Bissau as an institution. By championing reforms that enhance monetary stability and foster a more inclusive financial sector, he is laying groundwork for sustainable economic development that will benefit future generations. His leadership represents a commitment to sober, competent governance in a sector where stability is paramount. The legacy of João Fadia will be intrinsically linked to the perception of the BCGB as a pillar of trust and a catalyst for growth in the national business environment.

Net Worth & Business: A Public Servant's Profile

As a high-ranking public official and the head of a nation's central bank, João Fadia's professional life is defined by public service rather than private business ventures. The specifics of his net worth are not publicly disclosed, which is standard protocol for individuals in such positions to avoid conflicts of interest and maintain the integrity of the office. His income is derived from his official salary as the Governor of the Central Bank of Guinea-Bissau, which is set by national regulations commensurate with the responsibilities of the role.

It is important to distinguish that the role of a central bank governor is regulatory and macroeconomic in nature, not entrepreneurial. Therefore, João Fadia's "business," so to speak, is the management of the nation's monetary system. His success is not measured in personal wealth accumulation but in achieving key economic indicators: controlling inflation, maintaining exchange rate stability under the regional peg, ensuring a sound banking system, and contributing to a climate conducive to investment and growth in Guinea-Bissau. Any discussion of financial success in this context is rightly focused on the economic health of the nation he serves, reflecting the profound trust and responsibility vested in his office.

Note: This biography is constructed based on the known professional role and standard responsibilities of a central bank governor in the West African context. For the most current and specific details on policies, speeches, or official announcements, please refer to the official website of the Banco Central da Guiné-Bissau or reputable financial news sources covering the region.

Net Worth Analysis

João Fadia is a public servant and central bank governor, not a business magnate; his wealth likely stems from salary and career savings, not corporate ownership.

Quick Stats

Related People

Abbas Bonfoh

Governor BEAC Gabon

Abdel Kader Taleb Ould Abderrahmane

Governor Central Bank

Abdirizak Omar Mohamed

Governor Central Bank of Somalia

Ahmed Osman

Governor Central Bank of Djibouti