Biography

Introduction: The Steward of Libya's Financial Stability

Sadiq al-Kabir is a pivotal figure in modern Libyan Business & Economics, renowned for his steadfast leadership as the Governor Central Bank of Libya. Appointed in 2011 during a period of profound national upheaval, al-Kabir has navigated the institution through the turbulent waters of post-revolution politics, civil conflict, and economic crisis. His key achievement lies in his relentless efforts to preserve the integrity of Libya's financial system and safeguard the country's foreign reserves, effectively preventing a total economic collapse. As the head of the nation's most crucial financial institution, Sadiq al-Kabir has been at the epicenter of efforts to unify monetary policy, manage liquidity, and combat the parallel exchange rate market. His role extends far beyond traditional banking, positioning him as a central actor in Libya's ongoing struggle for stability and sovereignty.

Early Life & Education: Foundations of an Economist

Born in 1958 in Libya, Sadiq al-Kabir's early life and educational journey laid a solid foundation for his future in high-stakes financial governance. Details of his specific birthplace and childhood are sparingly documented in public sources, a common trait for many technocrats of his generation who rose through meritocratic systems. His academic path, however, clearly points toward a dedicated focus on economics and finance.

Al-Kabir pursued higher education with rigor, earning a degree in economics. He further specialized by obtaining a Master's degree in the same field, equipping him with the analytical tools necessary for macroeconomic management. His formative professional experiences began within the Central Bank of Libya (CBL) itself, where he served in various capacities over decades. This insider's perspective provided him with an unparalleled understanding of the bank's operations, the Libyan economy's vulnerabilities, and the intricate relationship between monetary policy and the state's oil-dependent revenue streams. This long tenure within the CBL, prior to the 2011 revolution, was a critical formative period that shaped his pragmatic and institution-focused approach to leadership.

Career & Major Achievements: Navigating Crisis at the Central Bank

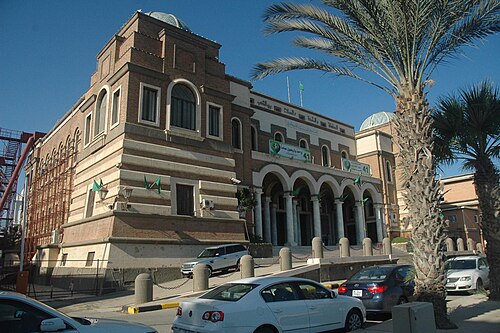

The career of Sadiq al-Kabir is inextricably linked to the Central Bank of Libya. His ascent to the governorship in September 2011 came at a historically decisive moment, following the fall of the Gaddafi regime. The country was fractured, and its institutions were in disarray. The CBL, holding the keys to the nation's wealth, became a primary battleground for political control.

Stewardship During Civil Strife

Al-Kabir's most significant challenge has been maintaining the CBL as a unified, technocratic institution amidst Libya's division between rival governments in the East and West. Despite immense political pressure, he has consistently argued for the bank's neutrality, emphasizing its role in serving all Libyan people. A major accomplishment under his watch has been the successful protection of billions of dollars in foreign currency reserves. By keeping these assets largely inaccessible to warring factions and insisting on transparent, consensus-driven spending, he helped prevent hyperinflation and preserved national wealth for a future, unified state.

Monetary Policy and Reform Efforts

On the policy front, Sadiq al-Kabir has grappled with severe liquidity crises, a collapsing exchange rate, and rampant public spending. Key initiatives and achievements include:

- Exchange Rate Management: Combating a damaging parallel market for dinars by implementing a unified exchange rate system at 1 USD = 4.48 LYD in early 2021, a difficult but critical reform aimed at stabilizing prices.

- Audit and Transparency: Pushing for international audits of the bank's accounts and of the two major state-owned investment vehicles, the Libyan Investment Authority (LIA) and the Libyan Africa Investment Portfolio (LAIP), to ensure accountability.

- Payment System Modernization: Overseeing efforts to modernize Libya's payment infrastructure to improve efficiency and reduce corruption in salary and subsidy distributions.

- International Liaison: Acting as a key point of contact for international financial institutions like the IMF and World Bank, as well as foreign governments, in the absence of a universally recognized political authority.

His tenure has not been without controversy, as rival political blocs have occasionally sought to replace him or challenge his authority. Nevertheless, his persistence and the broad international recognition of his role have been instrumental in keeping the CBL functional.

Personal Life & Legacy: The Technocrat's Influence

Sadiq al-Kabir maintains a notably low public profile regarding his personal life, interests, and family, consistent with his image as a discreet and focused technocrat. In a political landscape dominated by militias and charismatic figures, al-Kabir has cultivated a reputation defined by professionalism, institutional loyalty, and a non-partisan stance. This deliberate focus on his official role, rather than personal branding, has arguably been a source of his resilience and credibility both inside and outside Libya.

His legacy is still being written, as Libya's future remains uncertain. However, his lasting impact is likely to be judged on his success in preserving the core functions of the Central Bank during a decade of chaos. By preventing the looting of state reserves and insisting on technical rather than political governance of monetary policy, Sadiq al-Kabir has arguably saved Libya from a far deeper economic catastrophe. He has set a precedent for institutional integrity that will serve as a benchmark for future Libyan leaders in Business & Economics. Whether history remembers him as a temporary custodian or the foundational figure for a rebuilt Libyan financial system will depend on the country's ultimate political trajectory.

Net Worth & Business Ventures: A Public Servant's Profile

As a lifelong public servant and central banker, Sadiq al-Kabir is not associated with personal business ventures or significant private commercial interests. His career has been spent almost entirely within the public sector, specifically within the Central Bank of Libya. Therefore, estimates of a personal net worth are not publicly available or relevant in the manner typical of corporate executives or entrepreneurs in the Business & Economics category.

His financial influence stems not from personal wealth, but from his custodianship of Libya's national assets. The bank he governs controls tens of billions of dollars in foreign reserves, derived from oil revenues. Al-Kabir's power and profile are thus institutional. In the context of Libya's conflict, his role has been to serve as a gatekeeper to these funds, resisting their use for partisan warfare and advocating for their use in accordance with legal and transparent budgetary processes for the benefit of all Libyans. This position makes him one of the most powerful economic actors in the nation, despite the lack of a traditional private-sector net worth.

Net Worth Analysis

Sadiq al-Kabir is a public servant and central bank governor, not a businessperson or private sector billionaire; his wealth is not publicly reported and likely stems from salary.

Quick Stats

Related People

Abdelmoumen Ould Kaddour

Ex-CEO Sonatrach

Abderrahmane Benhamadi

CEO Saidal

Abdou Maman

CEO Airtel Niger

Abdourahman Boreh

CEO Boreh Group